"Want to Stop Insurance Companies From ROBBING Your Business Blind

—LEGALLY and Without Cutting Employee Benefits?!"

5 Day Event: LIVE March 24TH-28TH, @12-1 PM EST

Anthony Libecci

Your Host

"If Your Premiums Increased Again This Year, Your Insurance Broker Is Hiding Something From You..."

"If Your Premiums Increased Again This Year, Your Insurance Broker Is Hiding Something From You..."

WARNING: Insurance Companies Have a Secret System Designed to Overcharge Your Business By 30-50%... And Your Broker Won't Tell You About It!

WARNING: Insurance Companies Have a Secret System Designed to Overcharge Your Business By 30-50%... And Your Broker Won't Tell You About It!

"Your Business Could Be Bleeding Thousands Every Month While Your Broker Collects Fat Commission Checks..."

"Your Business Could Be Bleeding Thousands Every Month While Your Broker Collects Fat Commission Checks..."

If You Think Your Current Broker Is "Shopping Around" For Your Best Rates, You're Dangerously Mistaken.

Discover the Proven P.R.I.M.E. Method™ Fortune 500 Companies Use Instead to Slash Their Premiums, Access Better Coverage, and Keep More Money in Their Business.

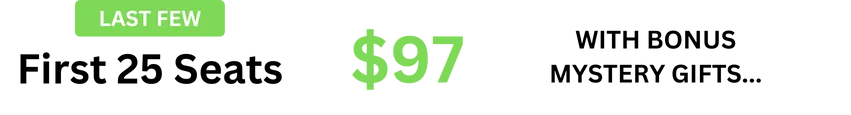

Join the Exclusive 5-Day "Health Insurance Savings Live" Challenge Today—Just $250 $97!

Challenge Starts In:

⏳ URGENT: Limited Spots Available—Doors Closing Soon!

Anthony Libecci

Your Host

REAL TALK (Disclaimer):

We are NOT your insurance broker, attorney, or financial advisor. We don't know your specific business situation, employee count, or current premiums—so, naturally, we can't possibly be giving you personalized insurance advice here.

This information is strictly for educational and entertainment purposes only. If you take action, your results depend entirely on you, your execution, your business situation, and probably how quickly you implement these strategies.

There's no magic wand here. Reducing your insurance costs takes real effort and real decisions. And let's face it: most businesses procrastinate, complain, and stay stuck overpaying forever. Don't be "most businesses."

When in doubt, consult a qualified insurance professional or financial advisor (but maybe not your current broker—they're probably part of the problem).

REAL TALK (Disclaimer):

We are NOT your insurance broker, attorney, or financial advisor. We don't know your specific business situation, employee count, or current premiums—so, naturally, we can't possibly be giving you personalized insurance advice here.

This information is strictly for educational and entertainment purposes only. If you take action, your results depend entirely on you, your execution, your business situation, and probably how quickly you implement these strategies.

There's no magic wand here. Reducing your insurance costs takes real effort and real decisions. And let's face it: most businesses procrastinate, complain, and stay stuck overpaying forever. Don't be "most businesses."

When in doubt, consult a qualified insurance professional or financial advisor (but maybe not your current broker—they're probably part of the problem).

REALITY CHECK:

Every Single Day, Businesses Just Like Yours Are Wasting Tens of Thousands of Dollars—Because They Mistakenly Trust Their Traditional Insurance Broker.

Here's the uncomfortable truth your broker won't tell you:

Your Current Insurance Strategy is BLEEDING Your Business Dry. You're likely overpaying by 30-50% for benefits that could be much better.

Traditional Brokers and Insurance Companies Take the First Bite of Your Money. Tens of thousands of your hard-earned dollars vanish into unnecessary premiums and hidden fees.

Your Business Faces Rising Costs Every Single Year. The moment you need cost control most—your broker will tell you "that's just how it is."

Do you really want to keep throwing money away while insurance companies and brokers profit from your ignorance?

The Fortune 500 Companies Know a Secret—And Now, You Can Too.

For years, America's largest companies have quietly used a simple, proven strategy to:

Slash premiums by up to 50%

Legally access Fortune 500-level benefits

Protect their bottom line from insurance company greed

And here's the best news:

No expensive consultants needed

No benefit cuts required

No complex implementation process

Imagine the impact on your bottom line when you're saving thousands every month—while giving your employees even BETTER coverage than before.

Health Insurance Savings Live

"Reveals The 'Sneaky' Strategy Big Companies Use to Slash Their Premiums, Fire Their Brokers, and Keep Insurance Companies from GOUGING Their Business!"

"Reveals The 'Sneaky' Strategy Big Companies Use to Slash Their Premiums, Fire Their Brokers, and Keep Insurance Companies from GOUGING Their Business!"

Starts In:

Spots Are Limited. Doors Are Closing Soon.

In Just 5 Days, I'll Hand You the Most POWERFUL Insurance Cost-Cutting Secret Ever Revealed...

In Just 5 Days, I'll Hand You the Most POWERFUL Insurance Cost-Cutting Secret Ever Revealed...

The P.R.I.M.E. Method™ Blueprint'

—The Exact Step-by-Step Framework Fortune 500 Companies Quietly Use to Slash Their Premiums, Access Elite-Level Benefits, and Keep More Money in Their Business...

—The Exact Step-by-Step Framework Fortune 500 Companies Quietly Use to Slash Their Premiums, Access Elite-Level Benefits, and Keep More Money in Their Business...

..Then I'll Give You My Proven, Easy-to-Follow Process That Legally Forces Insurance Companies to Give You Their Lowest Possible Rates, Guarantees Your Employees Get Better Coverage, and Ensures Your Business Stops Bleeding Money—No Matter What the Market Does.

..Then I'll Give You My Proven, Easy-to-Follow Process That Legally Forces Insurance Companies to Give You Their Lowest Possible Rates, Guarantees Your Employees Get Better Coverage, and Ensures Your Business Stops Bleeding Money—No Matter What the Market Does.

No Traditional Brokers. No Benefit Cuts. No Complex Implementation. Just Your Business Saving Thousands While Providing Better Benefits—Exactly as the Big Companies Do.

WARNING: Read This BEFORE You Claim Your Spot!

Let's get brutally honest. This event isn't for everyone. In fact, there are some business owners we absolutely do NOT want here.

Let's get brutally honest. This event isn't for everyone. In fact, there are some business owners we absolutely do NOT want here.

This Event Is PERFECT For You If:

You're sick of watching your premiums skyrocket every year, and you're determined to stop the bleeding once and for all.

You genuinely care about providing great benefits to your employees, but you know you're overpaying for what you're getting.

You believe your business deserves the same treatment as Fortune 500 companies—and you refuse to let insurance companies take advantage of you anymore.

You're smart, proactive, decisive, and ready to implement simple, proven strategies that big companies have quietly used for years (but your broker conveniently "forgot" to mention).

You're sick of watching your premiums skyrocket every year, and you're determined to stop the bleeding once and for all.

You genuinely care about providing great benefits to your employees, but you know you're overpaying for what you're getting.

You believe your business deserves the same treatment as Fortune 500 companies—and you refuse to let insurance companies take advantage of you anymore.

You're smart, proactive, decisive, and ready to implement simple, proven strategies that big companies have quietly used for years (but your broker conveniently "forgot" to mention).

This Event Is Definitely NOT For You If:

You secretly enjoy funding your broker's luxury lifestyle, and you think rising premiums are just "part of doing business."

You believe "hoping" and "wishing" are viable strategies for controlling insurance costs, and you're perfectly happy letting insurance companies dictate your rates.

You're a chronic procrastinator looking for another excuse to avoid making important decisions for your business's future.

You refuse to take responsibility, prefer to blame the market, or think someone else should magically solve your insurance problems for you.

You secretly enjoy funding your broker's luxury lifestyle, and you think rising premiums are just "part of doing business."

You believe "hoping" and "wishing" are viable strategies for controlling insurance costs, and you're perfectly happy letting insurance companies dictate your rates.

You're a chronic procrastinator looking for another excuse to avoid making important decisions for your business's future.

You refuse to take responsibility, prefer to blame the market, or think someone else should magically solve your insurance problems for you.

If you're in the first group—congratulations, you're exactly who we're looking for.

If you're in the second group—well, good luck with that. Maybe send your broker a thank-you note; I'm sure they'll appreciate the new vacation home you're buying them.

If you're in the first group—congratulations, you're exactly who we're looking for.

If you're in the second group—well, good luck with that. Maybe send your broker a thank-you note; I'm sure they'll appreciate the new vacation home you're buying them.

WARNING: This Former Aflac Top Producer Is Exposing The Insurance Industry's Dirty Secrets (And Brokers Are BEGGING Him To Stop)

WARNING: This Former Aflac Top Producer Is Exposing The Insurance Industry's Dirty Secrets (And Brokers Are BEGGING Him To Stop)

Hey, can I be blunt with you for a minute?

Anthony isn't what you'd expect. You know that slick insurance guy in the $2,000 suit who shows up once a year to tell you "sorry, rates are going up again"? Yeah, that's NOT Anthony.

Actually, he's kind of the black sheep of the insurance world. The guy that makes traditional brokers nervous at cocktail parties. (Seriously, they HATE him.)

But can you blame them? I mean, when you spend your career showing businesses how to stop overpaying for insurance, you don't exactly make friends with the folks getting fat commissions from those overpriced policies.

Here's the thing that drives me crazy... While most insurance "experts" are out there nodding their heads saying, "Sorry, there's nothing we can do about these rising rates," Anthony's over here helping regular businesses save thousands. And get this - their employees end up with BETTER coverage!

Want to know something wild? Before becoming the insurance industry's biggest pain-in-the-neck, Anthony spent over a decade crushing it at Aflac.

Not just reading about insurance in some textbook - we're talking hands-on, in-the-trenches experience, becoming one of their top leaders.

But here's the real kicker...

He figured out something that most brokers pray you never discover: There's a "secret backdoor" that lets regular businesses get the same sweetheart deals as Fortune 500 companies. We're talking group health, life insurance, voluntary benefits - the whole nine yards.

Think about it like this: Your current broker is probably playing "Let me shop this around" while Anthony's over here completely flipping the table on how insurance actually works.

I'm just gonna say it straight: Right now, your business is probably bleeding thousands of dollars because the system is literally designed to overcharge you. And Anthony?

He's made it his life's mission to help business owners like you stop the bleeding.

So you've got two choices here:

You can work with Anthony and finally get your insurance costs under control...

Or you can keep funding your broker's next vacation home. (I hear Maui is lovely this time of year.)

Your call.

Want to see exactly how this works? Let me break down what happens in each day of the challenge...

Hey, can I be blunt with you for a minute?

Anthony isn't what you'd expect. You know that slick insurance guy in the $2,000 suit who shows up once a year to tell you "sorry, rates are going up again"? Yeah, that's NOT Anthony.

Actually, he's kind of the black sheep of the insurance world. The guy that makes traditional brokers nervous at cocktail parties. (Seriously, they HATE him.)

But can you blame them? I mean, when you spend your career showing businesses how to stop overpaying for insurance, you don't exactly make friends with the folks getting fat commissions from those overpriced policies.

Here's the thing that drives me crazy... While most insurance "experts" are out there nodding their heads saying, "Sorry, there's nothing we can do about these rising rates," Anthony's over here helping regular businesses save thousands. And get this - their employees end up with BETTER coverage!

Want to know something wild? Before becoming the insurance industry's biggest pain-in-the-neck, Anthony spent over a decade crushing it at Aflac.

Not just reading about insurance in some textbook - we're talking hands-on, in-the-trenches experience, becoming one of their top leaders.

But here's the real kicker...

He figured out something that most brokers pray you never discover: There's a "secret backdoor" that lets regular businesses get the same sweetheart deals as Fortune 500 companies. We're talking group health, life insurance, voluntary benefits - the whole nine yards.

Think about it like this: Your current broker is probably playing "Let me shop this around" while Anthony's over here completely flipping the table on how insurance actually works.

I'm just gonna say it straight: Right now, your business is probably bleeding thousands of dollars because the system is literally designed to overcharge you. And Anthony?

He's made it his life's mission to help business owners like you stop the bleeding.

So you've got two choices here:

You can work with Anthony and finally get your insurance costs under control...

Or you can keep funding your broker's next vacation home. (I hear Maui is lovely this time of year.)

Your call.

Want to see exactly how this works? Let me break down what happens in each day of the challenge...

DAY 01

February 26th

12:00 - 1:30 PM EST

STOP BEING INVISIBLE:

How to Position Yourself as the ONLY Therapist Worth Paying!

What We Will Cover:

Why No One Knows You Exist—And How to Fix That Fast!

The Secret to Making People See You as the ONLY Logical Choice!

How to Craft an Offer So Irresistible, Clients Practically Beg to Work With You!

How to Stand Out in a Saturated Market (Even If Everyone Offers the ‘Same’ Thing)

How to Stand Out in a Saturated Market (Even If Everyone Offers the ‘Same’ Thing)

🎯 By the End of Day 1, You’ll Know EXACTLY How to Make Your Name Unignorable.

How to stand out from competitors—even in saturated markets.

🎯 By the End of Day 1, You’ll Know EXACTLY How to Make Your Name Unignorable.

DAY 02

February 27th

12:00 - 1:30 PM EST

RAISE YOUR PRICES

OR STAY BROKE:

The Art of Selling High-Ticket Therapy!

What We Will Cover:

Why Charging Higher Prices Attracts BETTER Clients (and Eliminates No-Shows)

How to Package Your Services Into Premium Offers That Clients Happily Pay For!

The Simple Confidence Hack to Charge More (Without Feeling ‘Salesy’ or Guilty)

How to confidently charge (and get) higher prices without resistance.

🎯 By the End of Day 2, You’ll Know How to Charge MORE and Attract Clients Who Actually Pay.

DAY 03

February 28th

12:00 - 1:30 PM EST

THE MONEY MULTIPLIER:

How to Attract & Close Multiple Clients at Once (Instead of 1:1 Calls)

What We Will Cover:

How to Run Group Presentations That Turn Strangers Into Paying Clients!

How One Company Used THIS Strategy to Go From $0 to $4B in 7 Years!

The ‘Silent Sales Machine’ That Pre-Sells Leads Before They Even Talk to You!

How to Get Your Clients to Pay for Your Marketing (And Be Excited About It!)

🎯 By the End of Day 3, You’ll Never Wonder Where to Find Clients Again.

How to get your clients to pay for your marketing & they'll be excited to do it!

🎯 By the End of Day 3, You’ll Never Wonder Where to Find Clients Again.

Here's EXACTLY What You'll Discover Inside the Exclusive 5-Day Health Insurance Savings Challenge:

The 5-Day LIVE Event Breakdown: What to Expect

Day 1: "The Great Insurance Heist EXPOSED"

WARNING: REVEALED: The sneaky way insurance companies are secretly overcharging you by 30-50% (and your broker is letting them do it)

WARNING: REVEALED: The sneaky way insurance companies are secretly overcharging you by 30-50% (and your broker is letting them do it)

The SHOCKING truth about why shopping for "competitive quotes" is actually keeping your rates high

How to instantly spot if your broker is working for you... or the insurance company (Hint: check their vacation photos)

Day 2: "The Fortune 500 Playbook"

The "secret club" that gives big companies amazing benefits at rock-bottom prices (and how to sneak your way in)

Why size doesn't matter: How even a 10-person company can get Fortune 500-level rates

The P.R.I.M.E. Method™ that forces insurance companies to give you their absolute lowest rates (they hate when I share this)

Day 3: "The PEO Profit Miracle"

How to legally "piggyback" onto massive group rates (even if you're a tiny business)

How to legally "piggyback" onto massive group rates (even if you're a tiny business)

The exact word-for-word script to announce changes to your employees (they'll thank you for this)

The 3 deadly PEO selection mistakes that could cost you a fortune (and how to avoid them)

Day 4: "Your Broker's Worst Nightmare"

The hidden fees and commissions eating your profits alive (this will make you angry)

The hidden fees and commissions eating your profits alive (this will make you angry)

How to make insurance companies compete for your business (instead of the other way around)

The "reverse leverage" strategy that sends brokers into panic mode

How to easily implement these critical protections NOW, before disaster strikes your family.

Day 5: "Your Insurance Liberation Blueprint"

Your complete implementation roadmap (copy-and-paste simple)

Your complete implementation roadmap (copy-and-paste simple)

How to minimize future rate increases (and maintain maximum savings year after year)

The "broker-proof" renewal strategy that keeps you in control

"Spoiler Alert: Your Broker Already Picked Out His New Beach House"

⏳ He's Really Hoping You'll Keep Scrolling... (Don't Make His Day)

Starts In:

Normal Price: $250 Special One-Time Price: ONLY $97

Imagine the relief you'll feel, knowing your business is finally paying what it SHOULD for health insurance—without the bloated premiums, broker manipulation, or insurance company greed.

URGENT WARNING: Your Business Is Being Systematically OVERCHARGED...

From: Anthony Libecci

Former Aflac Top Producer & Insurance Industry Whistleblower

Location: Holmdel, NJ

Hey fellow business owner,

STOP EVERYTHING YOU'RE DOING AND READ THIS NOW.

Because at this very moment, your business is hemorrhaging money on overpriced health insurance. And every month you wait to fix it – your profits are being drained away by a system designed to overcharge you.

DEVASTATING FACT: In the next 60 seconds, another business will write a check for 30-50% MORE than they should be paying for health insurance. By the time you finish reading this letter, three more businesses will do the same.

⚠️ THIS IS NOT A DRILL ⚠️

Your "traditional broker relationship" – that annual renewal meeting you dread – is almost WORTHLESS against the sophisticated system insurance companies use to systematically overcharge businesses like yours.

THINK ABOUT THIS:

Your premiums? INFLATED.Your profits? DRAINED. Your options? LIMITED.Your employees' benefits? COMPROMISED.

And here's the most infuriating part: This systematic overcharging is happening RIGHT NOW to businesses who think their broker is "shopping around for the best rates."

You have exactly TWO CHOICES:

Take immediate action (while you still can)Join the growing list of businesses being financially DRAINED by overpriced insurance

The clock is ticking... tick... tick... tick...

Every month you wait to address this is another month of overpaying. And those overpayments? You'll NEVER get them back.

Answer Honestly—Does This Sound Like You?

If your renewal came tomorrow, are you 100% confident you're not being overcharged by 30-50% on your premiums?

If your broker presented next year's rates, would you know for certain whether they actually found you the best possible deal?

If your employees asked why their benefits keep getting worse while costs keep rising, would you have a good answer?

If you answered "NO" or "I'm not sure" to ANY of these questions, then you're probably overpaying for your health insurance—and that's a leak in your profits you cannot afford to ignore.

The Good News: It’s NOT Too Late—Yet.

You can still take control TODAY. You can still protect your profits, your employees, and your bottom line.

But make no mistake: This is your moment of decision.

You either ACT NOW and transform your insurance strategy—or you keep overpaying month after month, year after year.

⚠️ BUT READ THIS CAREFULLY:

This special event has strictly LIMITED SEATS. We're keeping this small and exclusive. Once it's filled—it's GONE.

⏳ DON'T RISK LOSING YOUR SPOT—REGISTER NOW.

Normal Price: $250 | Limited-Time Price: ONLY$97

The Question You MUST Ask Yourself Right Now…"

At this exact moment, you have a critical choice to make. And your business's financial future hangs in the balance.

Here's the single most important question you can ask yourself right now:

"Am I Really Willing to Keep Throwing Away Thousands of Dollars Every Month on Overpriced Insurance—While My Broker Gets Rich and My Employees Get Less?"

If your answer is "NO," then this exclusive 5-day challenge was created specifically for YOU.

Because here's what's at stake if you do nothing:

Insurance Costs Will Keep Skyrocketing—Eating more and more of your profits every single year.

Your Broker Keeps Getting Richer—While you keep writing bigger and bigger checks for worse coverage.

Your Employees Get Less—While paying more out of pocket, hurting both morale and retention.

Is THAT the Future You Want for Your Business?

But It Doesn’t Have to Be This Way…

Inside the 5-Day "Health Insurance Savings Challenge," you'll

discover the exact blueprint smart businesses use to:

Instantly slash their premiums—keeping more profit in their business where it belongs.

Access Fortune 500-level benefits—giving their employees better coverage for less money.

Take control of your insurance strategy—ending the cycle of annual rate hikes and benefit cuts.

Sleep soundly at night—knowing you're not being taken advantage of anymore.

Here's Exactly What Makes This Event So Different:

ZERO Complex Insurance Jargon—Just clear, easy-to-follow steps any business owner can understand and implement. No insurance degree required

REAL, Proven Strategies—Not theory. Not guesswork. These are the exact same strategies that saved an electrical contractor 63%, a dental practice $48,000, and a medical practice $200,000.

Immediate Action & Results—You'll leave each session with specific, actionable steps you can take immediately. No waiting months to see results.

Expert Guidance Every Step of the Way—Live Q&A sessions where Anthony answers your specific questions about your unique situation.

"Seriously—Is Your Broker's Kid's Private School Tuition REALLY Your Problem?"

⏳ Seats Are Limited, and Your Broker Is Hoping You'll Procrastinate. Don't Give Them That Satisfaction!

Starts In:

Regular Price: $250 | TODAY ONLY $97

"Still Skeptical? Good. You SHOULD Be."

"Still Skeptical? Good. You SHOULD Be."

Here's a dirty little secret most insurance brokers WON'T tell you:

They LOVE when you're skeptical, confused, and stuck doing nothing... because your indecision literally funds their commissions.

But don't take my word for it—listen to the smart, skeptical business owners who decided to take control of their insurance costs:

"I was paying $13,000 a month for our group health plan. After implementing Anthony's strategy, we cut that down to $4,800... AND our employees got better coverage! My broker won't return my calls anymore. I wonder why... 😂"

Mike R., Electrical Contractor[Saved: $98,400/year]

"Honestly? I thought it was too good to be true. But my dental practice was bleeding money on insurance costs. After the challenge, we saved $48,000 in the first year alone. My only regret is not doing this sooner!"

Dr. Sarah K., Dental Practice Owner[Saved: $48,000/year]

"As a medical practice owner, I thought I knew all about health insurance. Boy, was I wrong! This strategy saved us over $200,000 this year. My broker must be crying into his martini right now."

Dr. James W., Medical Practice Owner[Saved: $200,000/year]

Do NOT Wait Another Second—Take Control NOW.

You can keep being skeptical, keep waiting, and keep funding your broker's luxury lifestyle... OR you can join these smart business owners and insurance-proof your bottom line TODAY.

✅ Save up to 50% on your premiums

✅ Give your employees better benefits

✅ Make your broker actually work for their commission (shocking, we know!)

✅ Stop bankrolling your broker's country club membership

✅ Finally take control of your insurance costs

Act Fast—Make a Broker Cry Today!

"How to Save on Health Insurance Without Funding Your Broker's Third Vacation Home"

Challenge Starts In:

100% Money Back Guarantee

Look, I get it. You've probably heard every promise under the sun from insurance brokers before. And let's be honest - most of them turned out to be about as reliable as a chocolate teapot.

So here's my "Put Your Money Where Your Mouth Is" Guarantee:

If by the end of this 5-day challenge, you don't see EXACTLY how to slash your insurance costs while improving benefits...

If you don't get a clear, step-by-step blueprint for transforming your insurance strategy...

If you're not 100% convinced this will save your business serious money...

Then just let us know, and we'll give you 100% of your money back. No questions asked. No awkward conversations. No broker-style excuses.

You'll get every penny back, AND you keep all the bonuses.

Why am I so confident? Because unlike your broker, I actually have to PROVE my value - not just show up once a year with bad news and a expense report.

Join The challenge now

"A system that transforms your insurance costs from nightmare to no-brainer."

Challenge Starts In:

Attend 'Health Insurance Savings Challenge' Below

🔒Secure Order Form

YES! Save My Spot For The 'Health Insurance Savings Challenge'!

PRICE TODAY: $250 $97!

Use Code SAVE50

JOIN THE ' 30 APPOINTMENT CHALLENGE ' BELOW

🔒Secure Order Form

All 3 Days For Just : $97!

Your discount code is "SAVE50", use it before the timer below hits 0 to get 50% off...

Your discount code is "SAVE50", use it before the timer below hits 0 to get 50% off...

This site is not part of the Facebook website or Facebook Inc. Additionally, this site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

Copyright 2025. All Rights Reserved.

REAL TALK (Final Disclaimer):

We are NOT your insurance broker, attorney, or financial advisor. We don't know your specific claims history, employee count, or current premiums—so, naturally, we can't possibly be giving you personalized insurance advice here.

This information is strictly for educational and entertainment purposes only. If you take action, your results depend entirely on you, your execution, your business situation, and probably how quickly you implement these strategies.

There's no magic wand here. Reducing your insurance costs takes real effort and real decisions. And let's face it: most businesses procrastinate, complain, and stay stuck overpaying forever. Don't be "most businesses."

When in doubt, consult a qualified insurance professional (but maybe not your current broker—they're probably too busy shopping for their next vacation home).